First Choice Debt Solutions targets businesses and blue-collar workers to mitigate long outstanding debt and other MCA Debts while protecting your credit score, ensuring your business continues to run smoothly.

Don't be a victim to

Merchant Cash Advances

Choose your debt amount - $50,000

Pay as little as

1,350+ Clients

Regain your Financial

Freedom with us!

First Choice Debt Solutions help business owners to regain control of their cash flow by eliminating bad debts to rebuilding credibility and ensuring financial stability.

Our Process

Discovery Call

Step 1

Book a free, confidential consultation with one of our Senior Debt Relief Specialists

Custom Proposal & Agreement

Step 2

Get ready to be wowed by a tailored plan that seamlessly aligns with your vision, complete with bundled services and transparent terms - no surprises, just results.

Onboarding Kickoff Meeting

Step 3

Welcome to the VIP club! Gear up for a VIP experience, complete with meeting your team, and getting a clear roadmap to operate your business with confidence and a clear head.

Strategic Planning & Setup

Step 4

Buckle up, because we're about to conduct a deep dive audit, implement a comprehensive debt relief plan, and set you up for success financial stability.

Transform Your Life and Your Business by focusing on what you do best — Growing your Business!

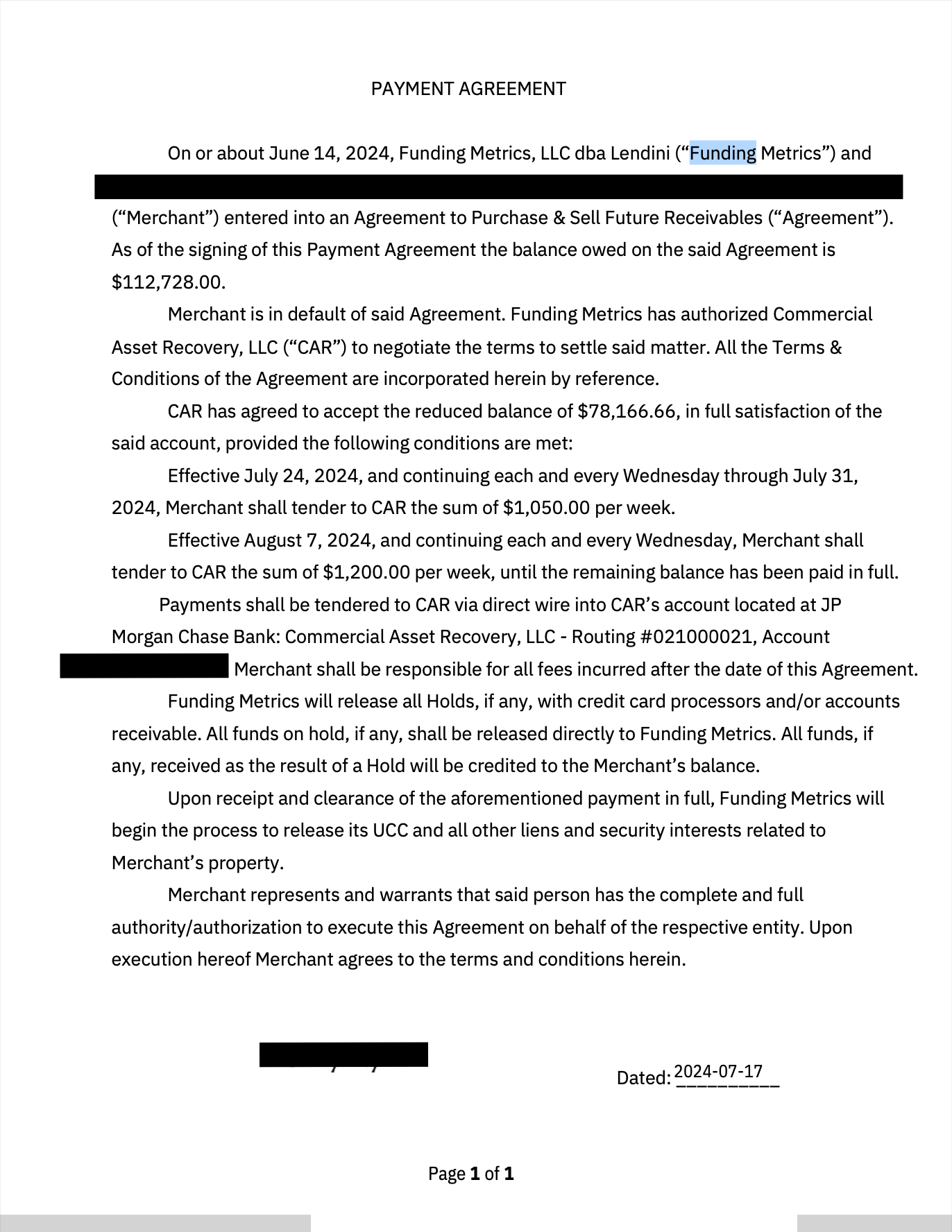

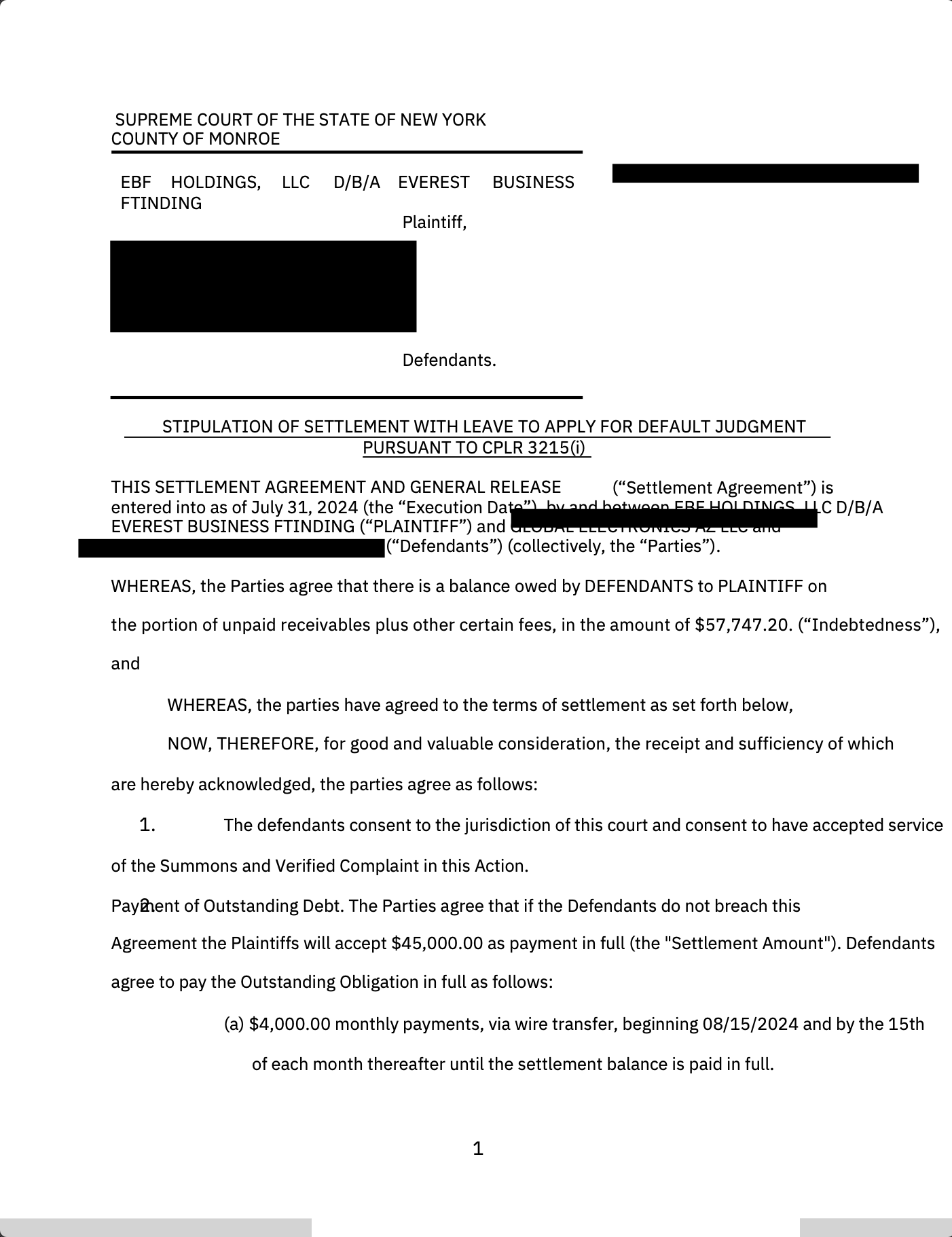

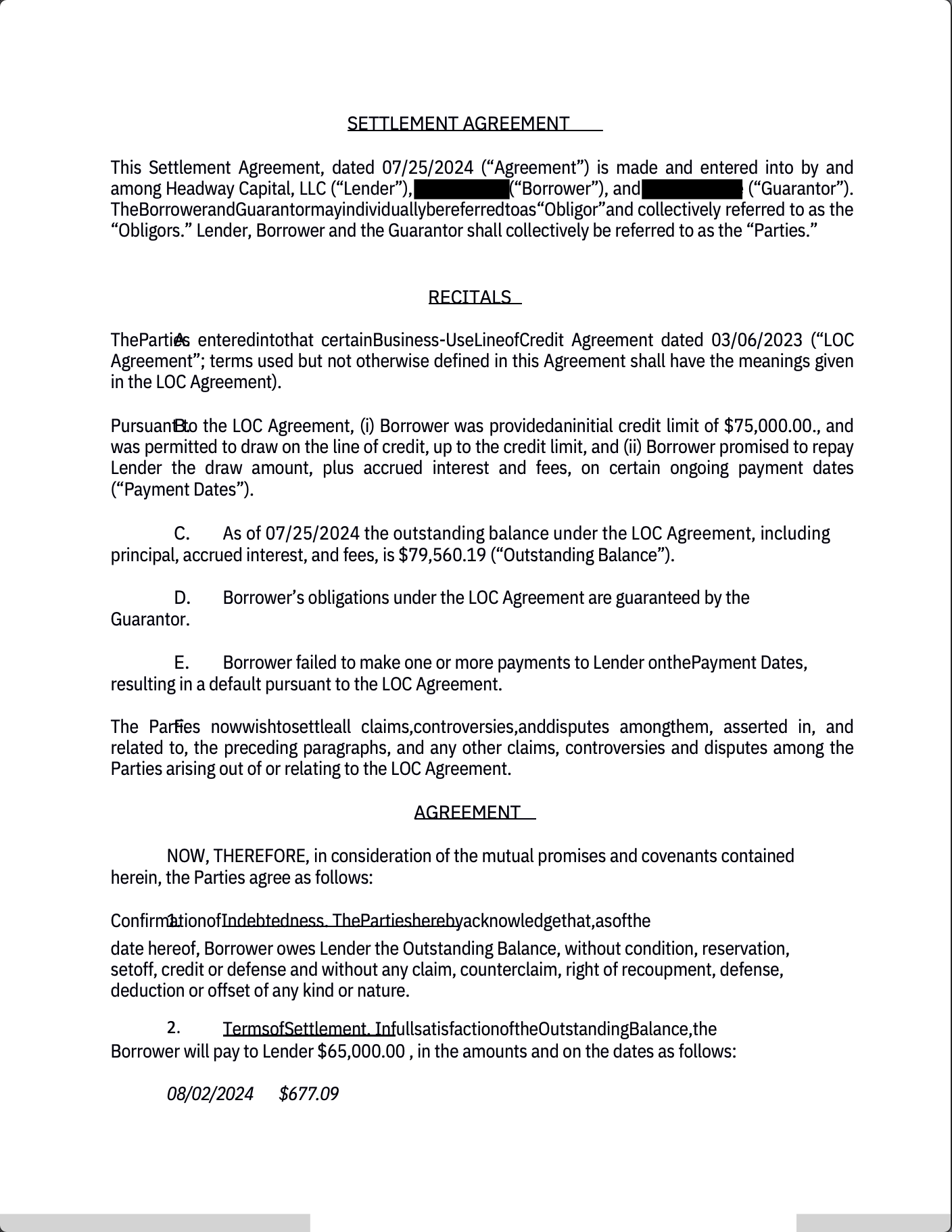

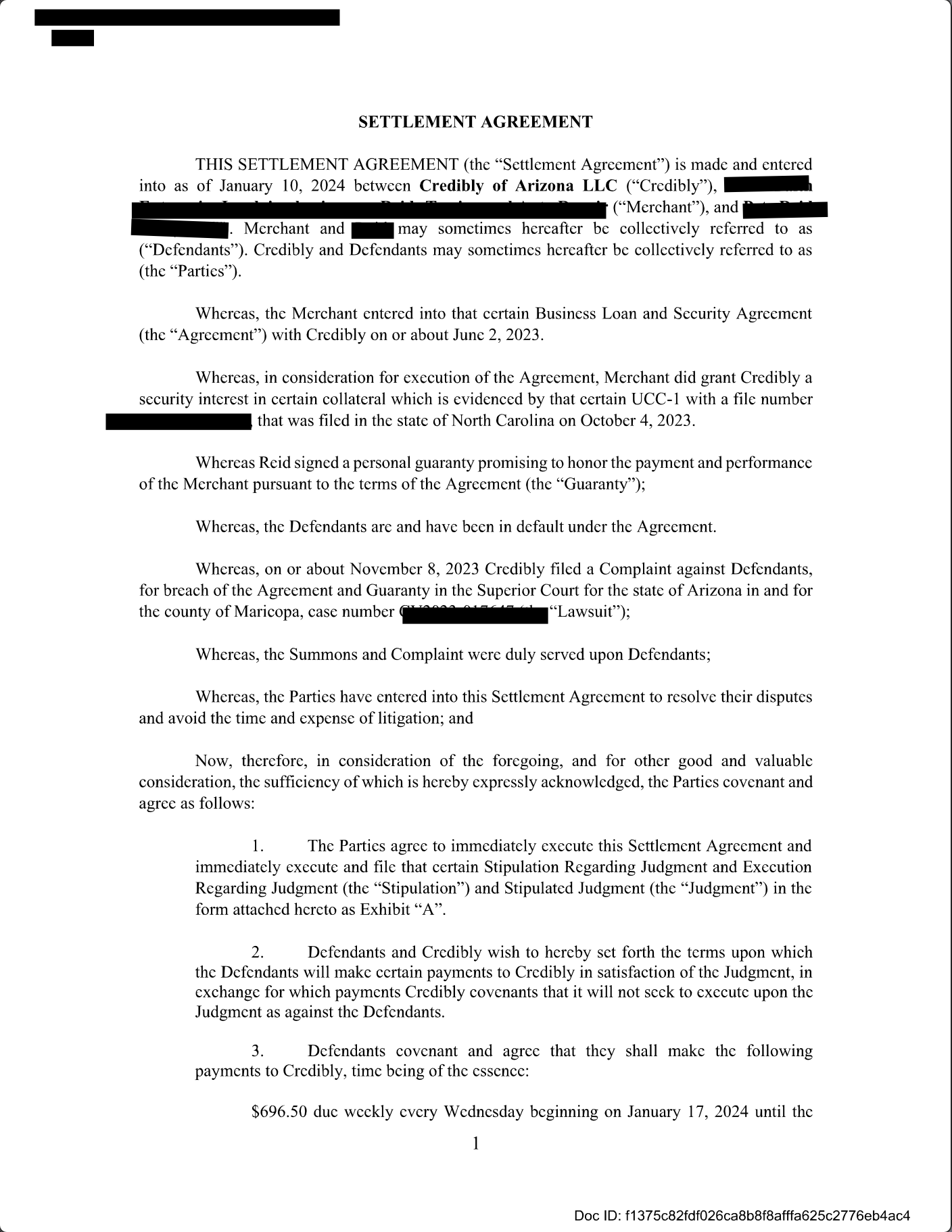

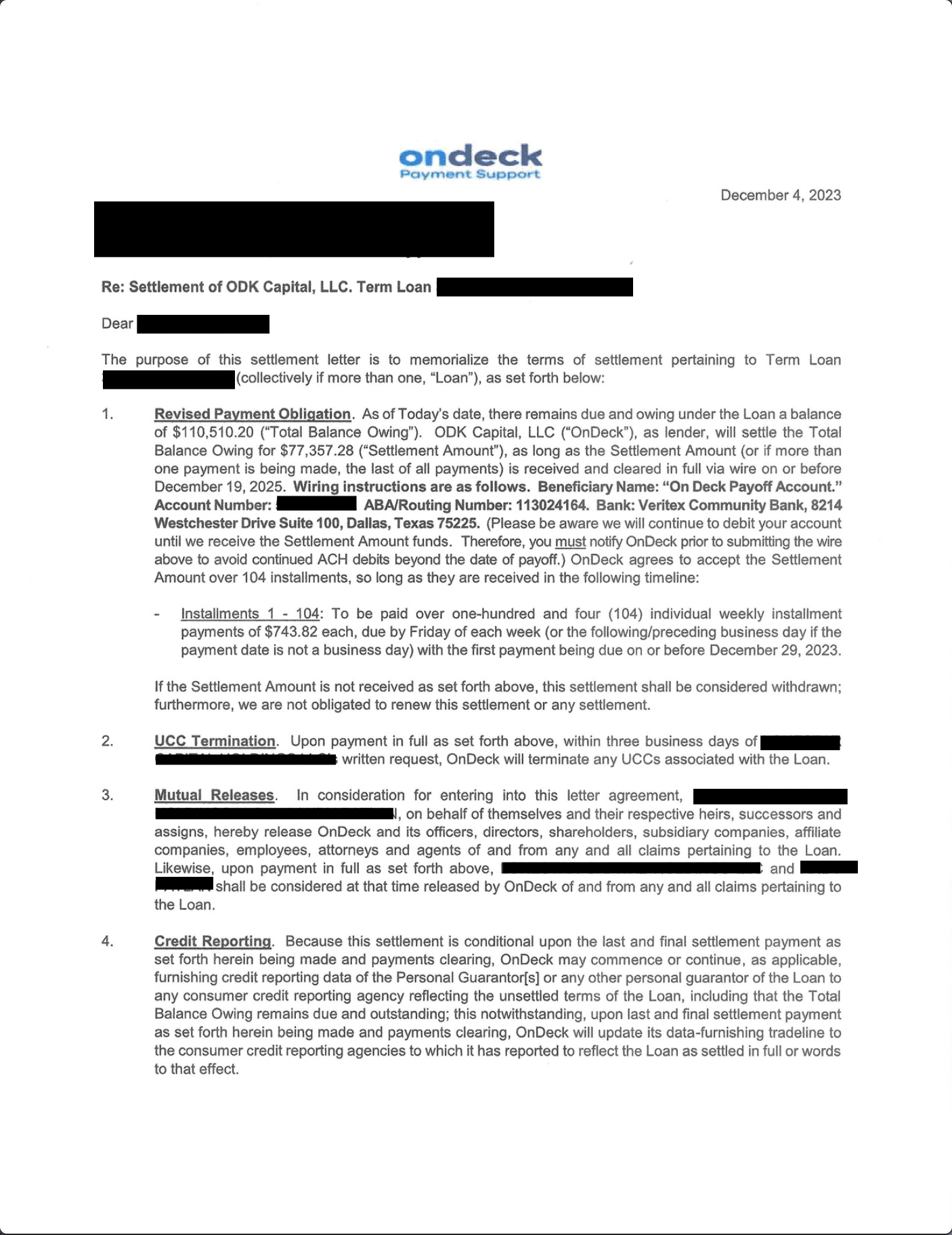

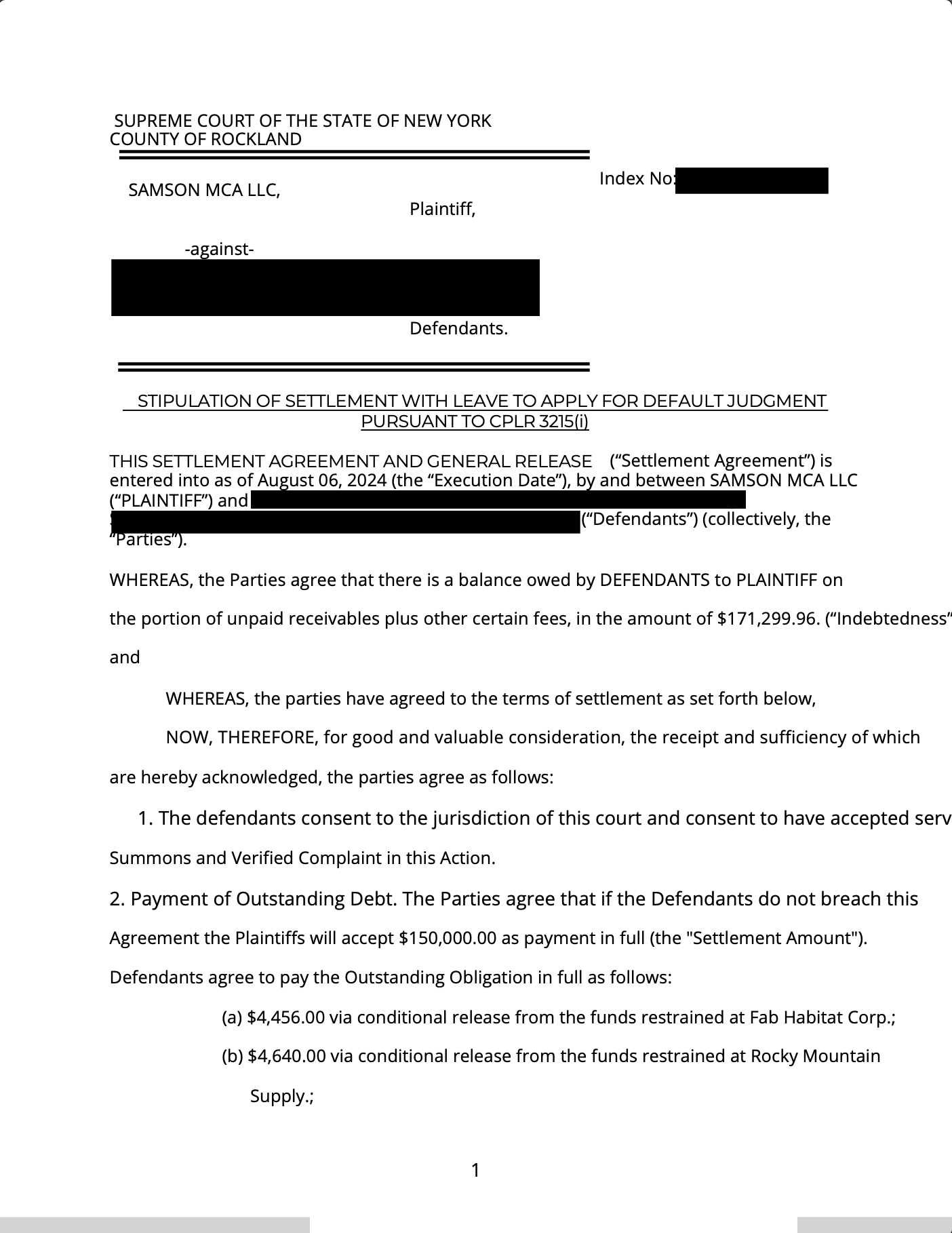

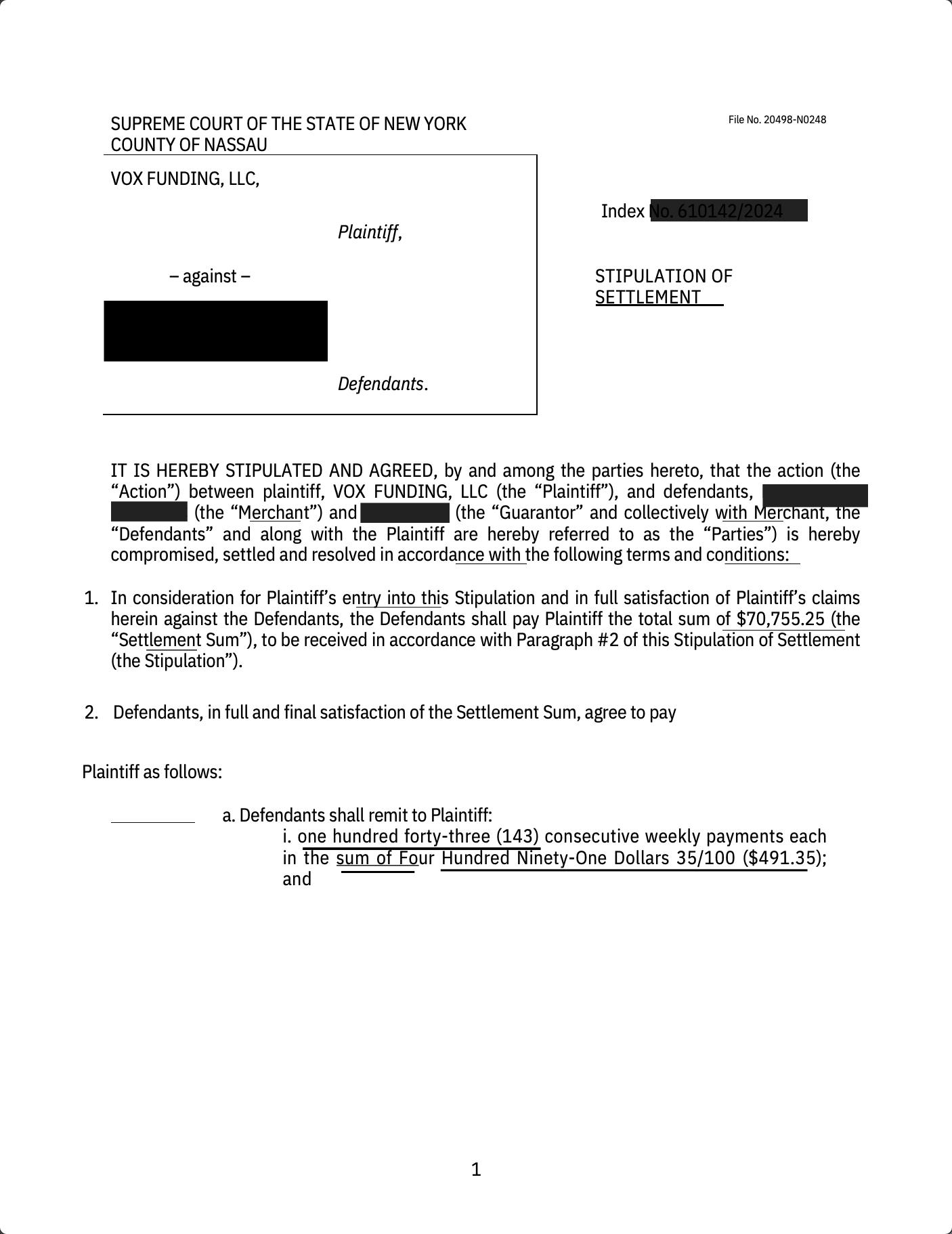

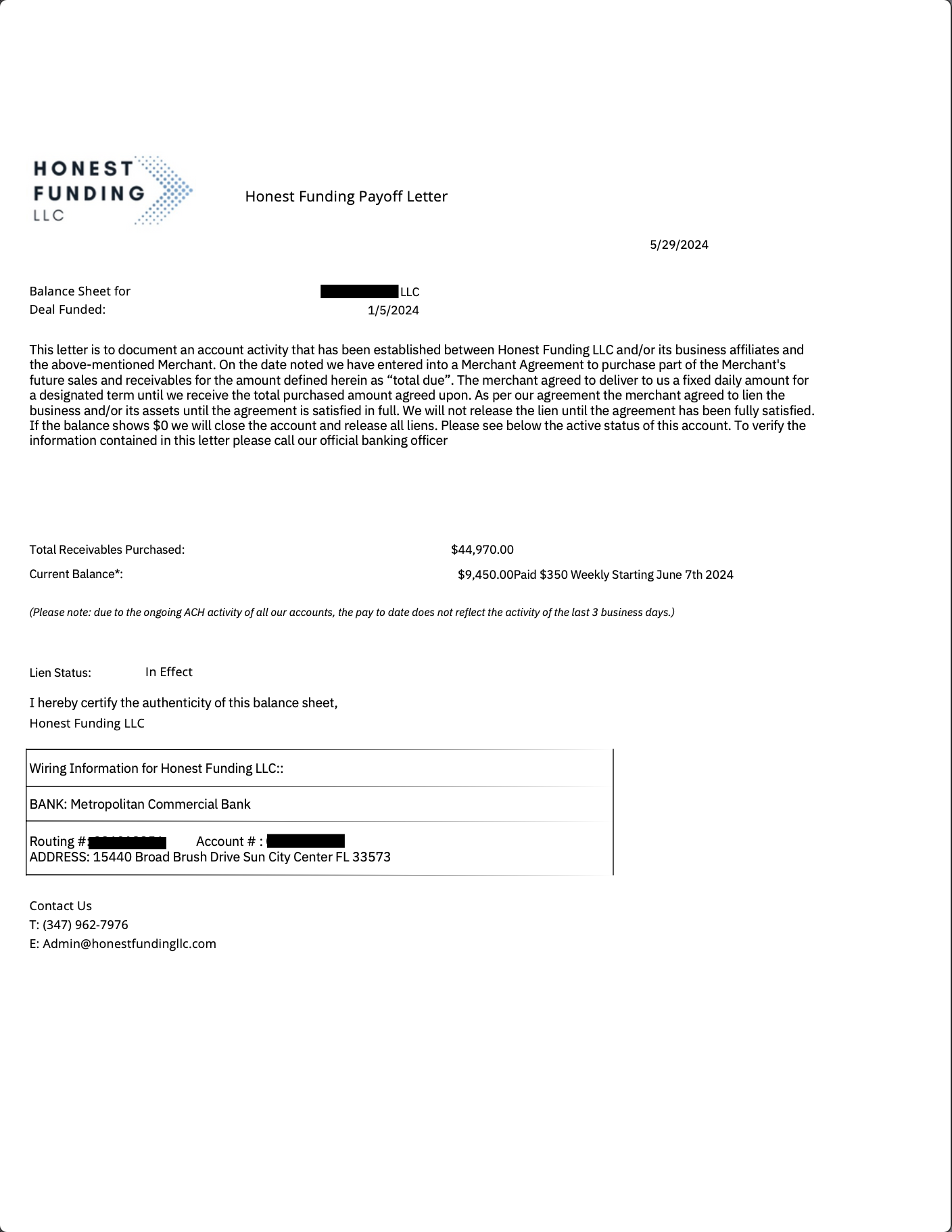

Our Recent Results

Client Results

Follow Us on Instagram

Stay connected with our latest updates, behind-the-scenes content, and customer highlights.

We Serve

What Makes us Your Perfect Partner ?

Specializing in MCA debts, we convert multiple high daily payments into 1 low weekly payment for business owners of construction, trucking, restaurants, healthcare, auto repair and many more industries to get you debt free within 6-8 months

- Protect Assets

- Manage MCA Debt

- Financial Stability

Blog & Insights

The Difference Between Survival Thinking and Growth Thinking

Every business shifts between two mindsets during its lifetime. One is survival thinking. The other is growth thinking. Both are necessary, but they serve very different purposes. Problems begin when businesses confuse the two or stay in the wrong one for too long.

The Silent Phase Before a Business Collapse

Most businesses do not fail suddenly. Collapse is usually quiet at first. There is a phase where everything looks normal from the outside. Sales are still coming in, and staff are still working. Operations continue. But inside, pressure is building.

What Happens Inside a Business Six Months Before It Shuts Down

Most businesses do not fail overnight. Closure is rarely sudden. In most cases, the decision to shut down is made months after the damage has already begun. From the outside, things may look normal. The website is live. Employees show up. Sales still happen. But inside, the business is already struggling to survive.