First Choice Debt Solutions targets businesses and blue-collar workers to mitigate long outstanding debt and other MCA Debts while protecting your credit score, ensuring your business continues to run smoothly.

Solutions to Master

Your

Choose your debt amount - $50,000

Pay as little as

1,350+ Clients

Regain your Financial

Freedom with us!

First Choice Debt Solutions help business owners to regain control of their cash flow by eliminating bad debts to rebuilding credibility and ensuring financial stability.

Our Process

Discovery Call

Step 1

Book a free, confidential consultation with one of our Senior Debt Relief Specialists

Custom Proposal & Agreement

Step 2

Get ready to be wowed by a tailored plan that seamlessly aligns with your vision, complete with bundled services and transparent terms - no surprises, just results.

Onboarding Kickoff Meeting

Step 3

Welcome to the VIP club! Gear up for a VIP experience, complete with meeting your team, and getting a clear roadmap to operate your business with confidence and a clear head.

Strategic Planning & Setup

Step 4

Buckle up, because we're about to conduct a deep dive audit, implement a comprehensive debt relief plan, and set you up for success financial stability.

Transform Your Life and Your Business by focusing on what you do best — Growing your Business!

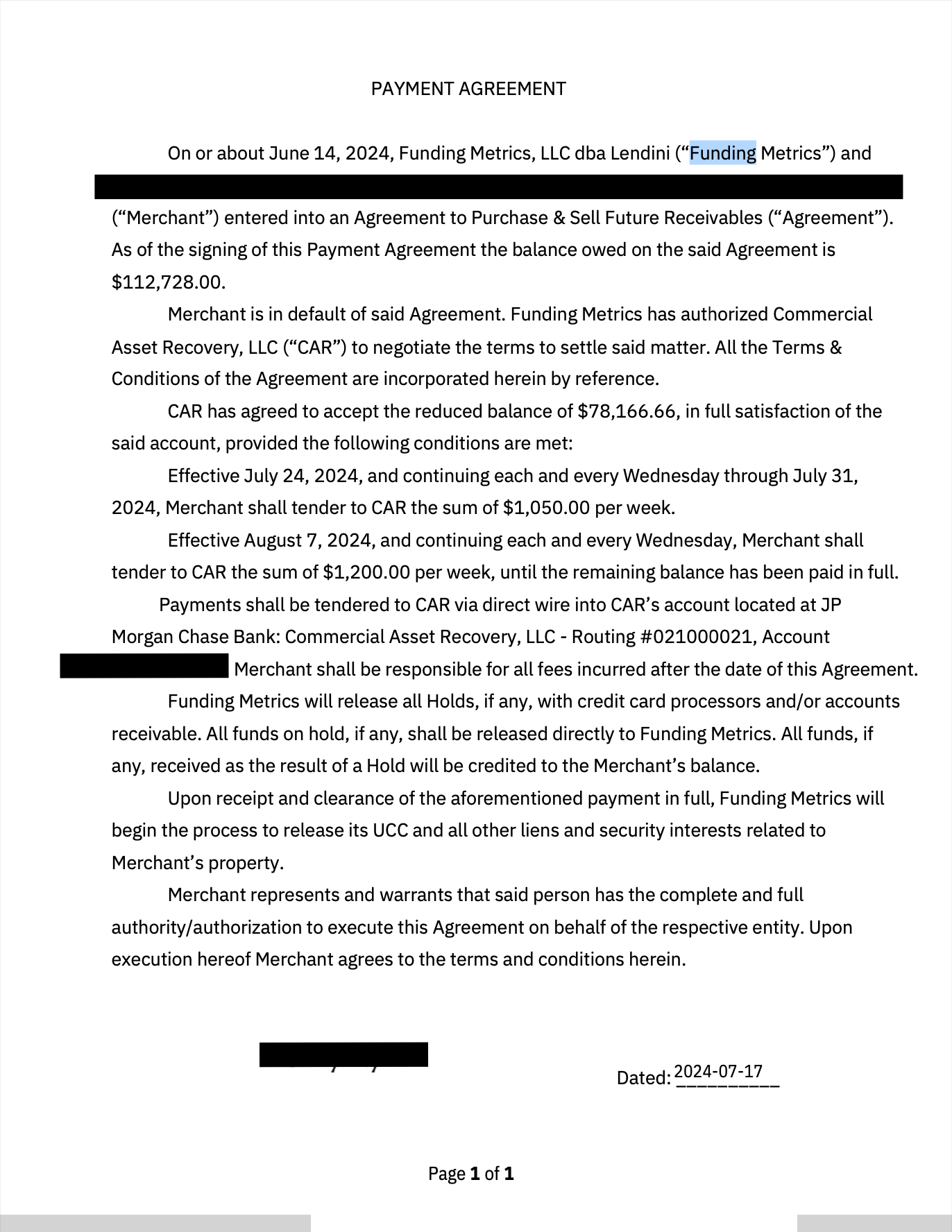

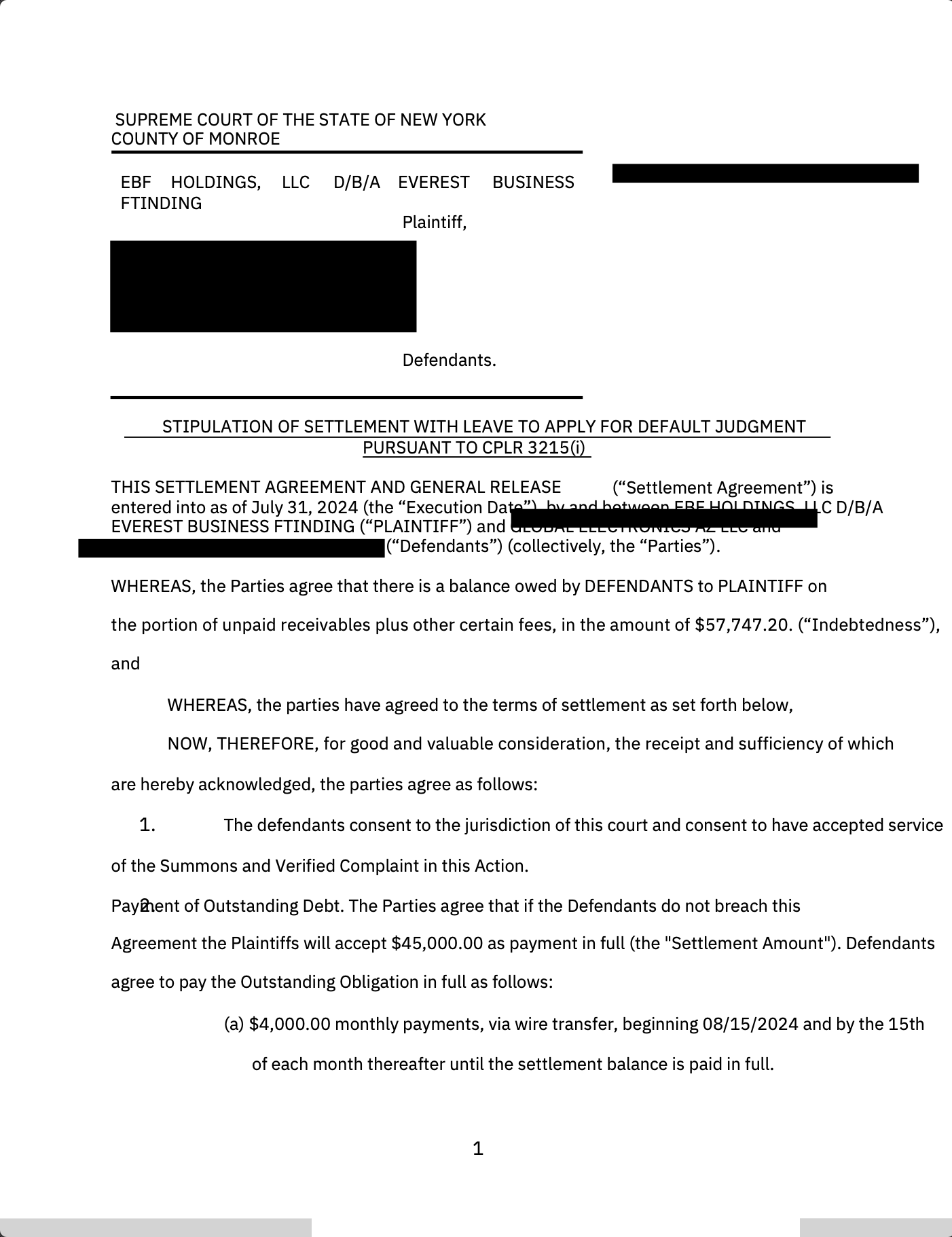

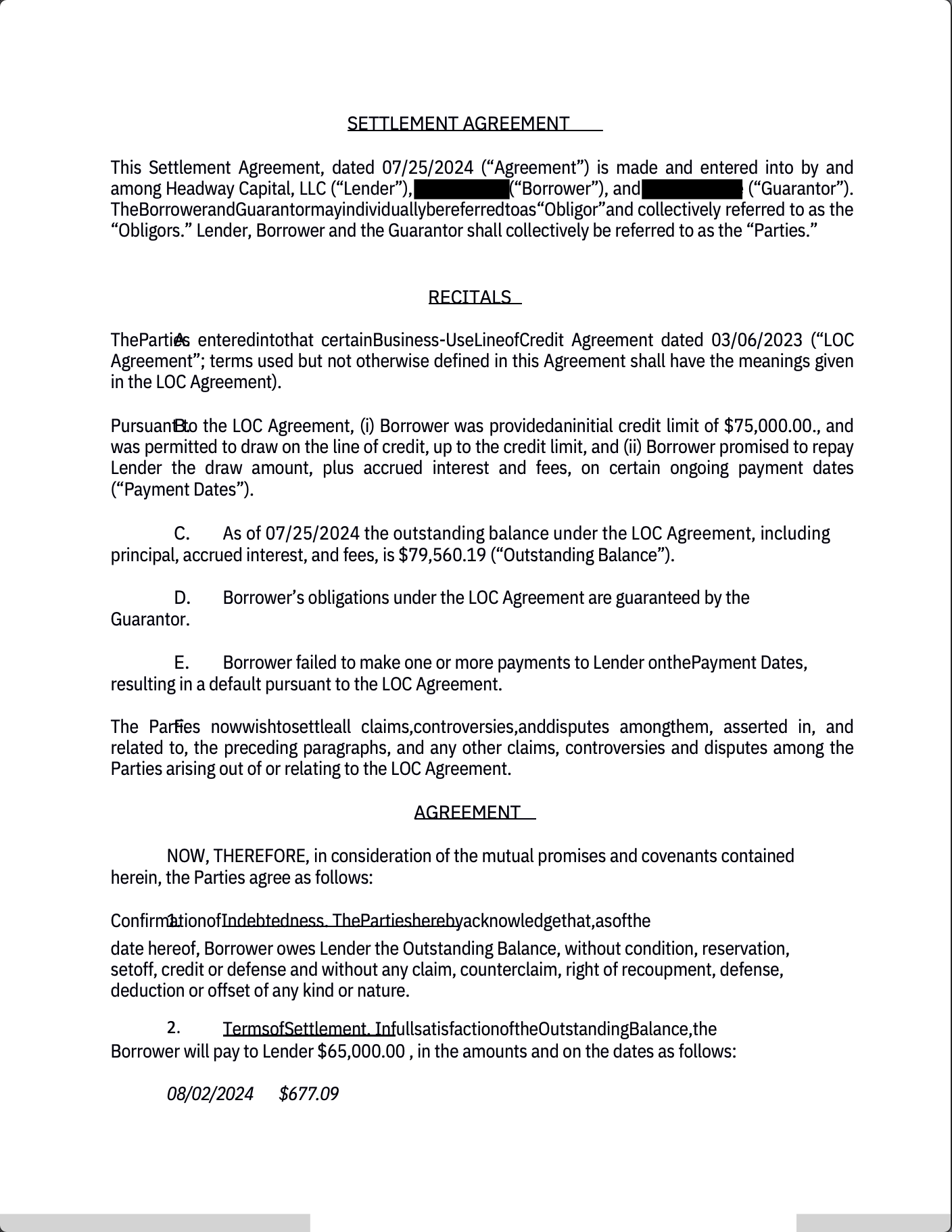

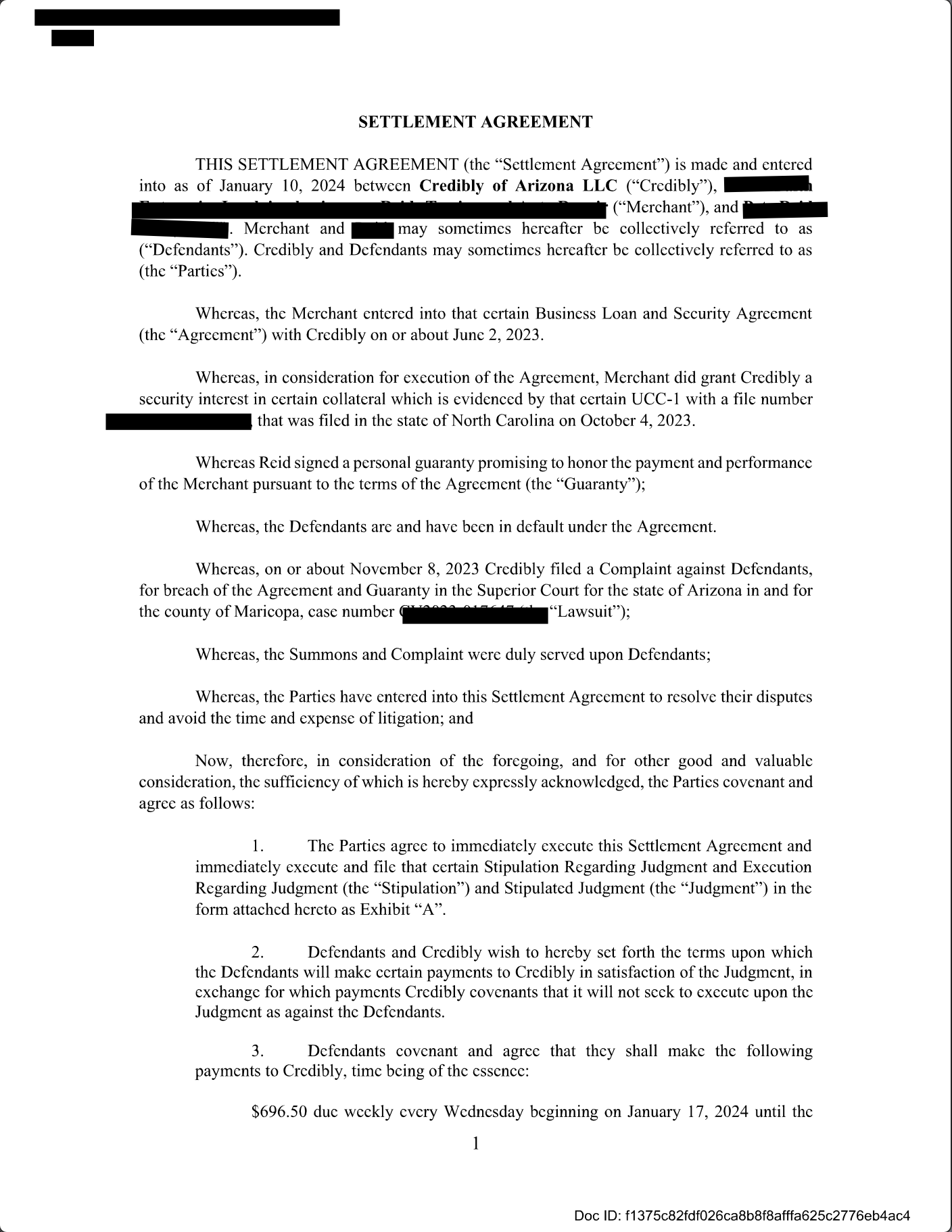

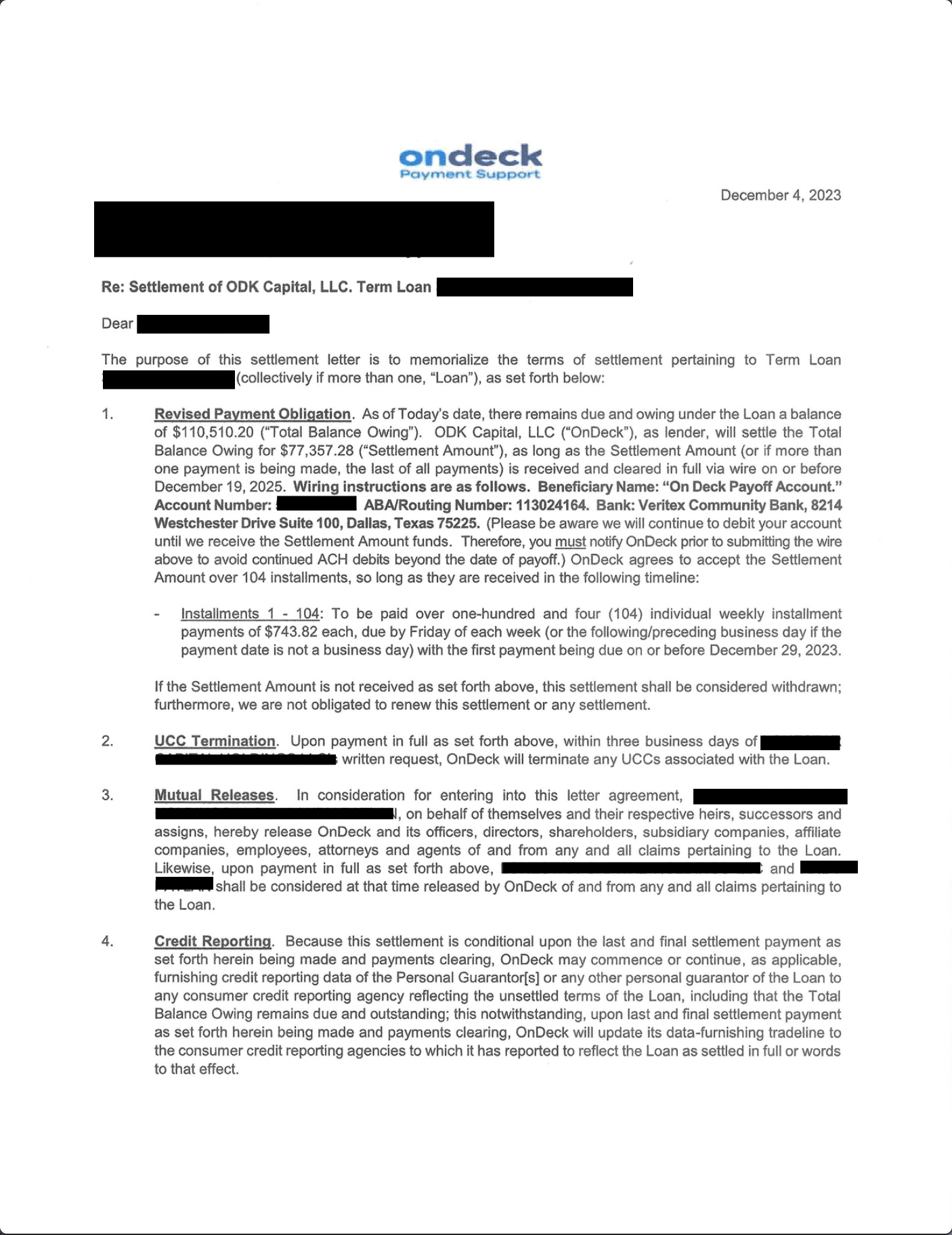

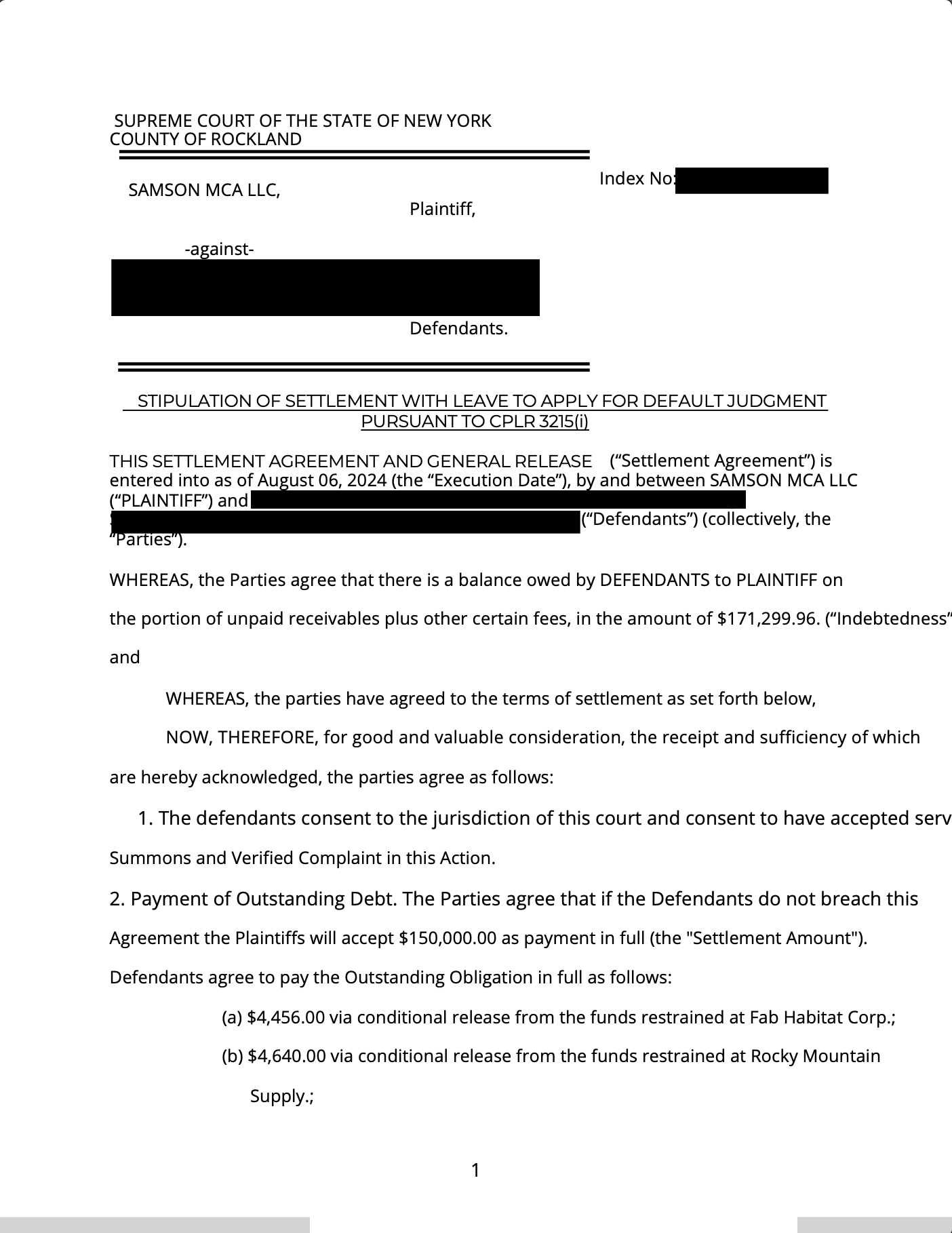

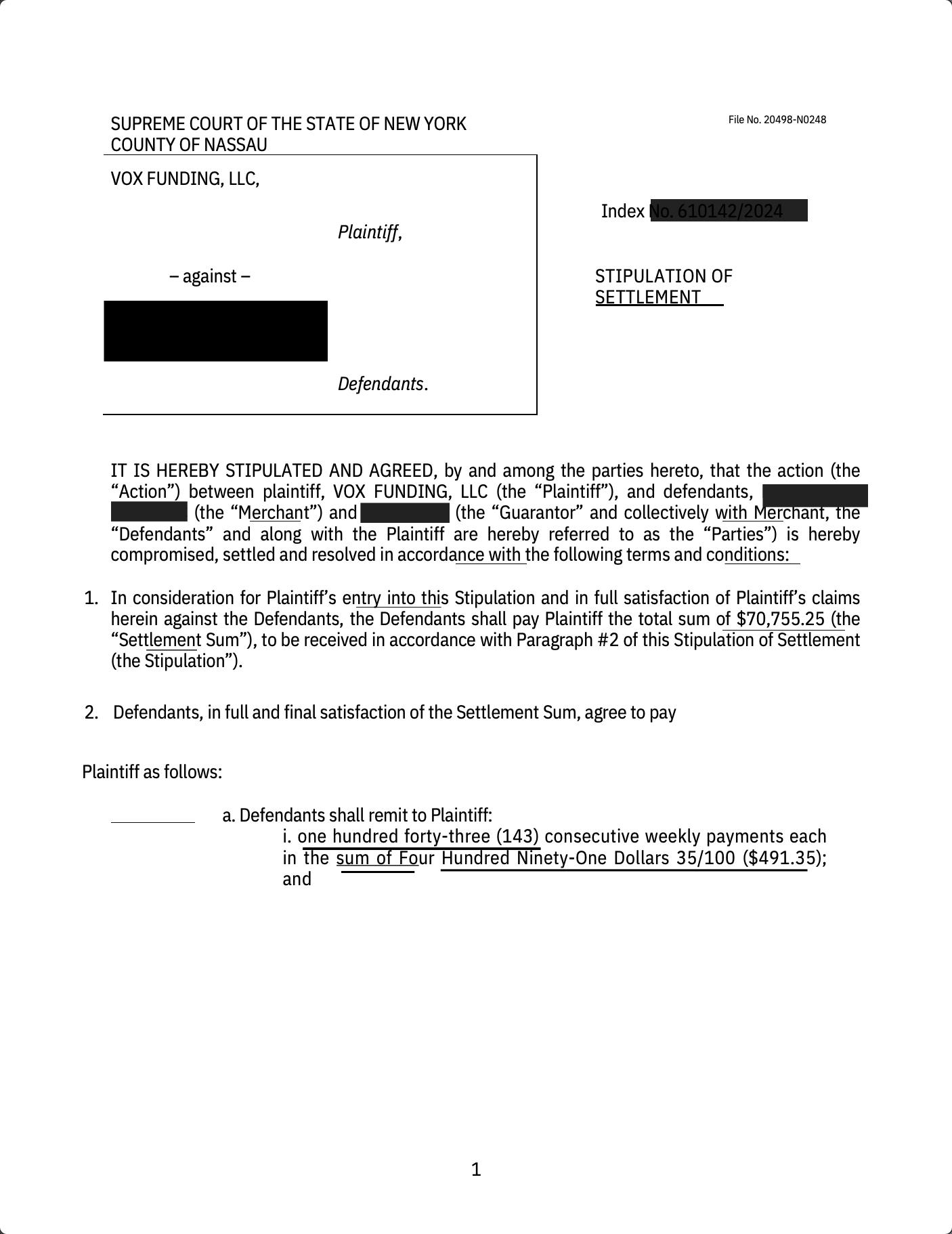

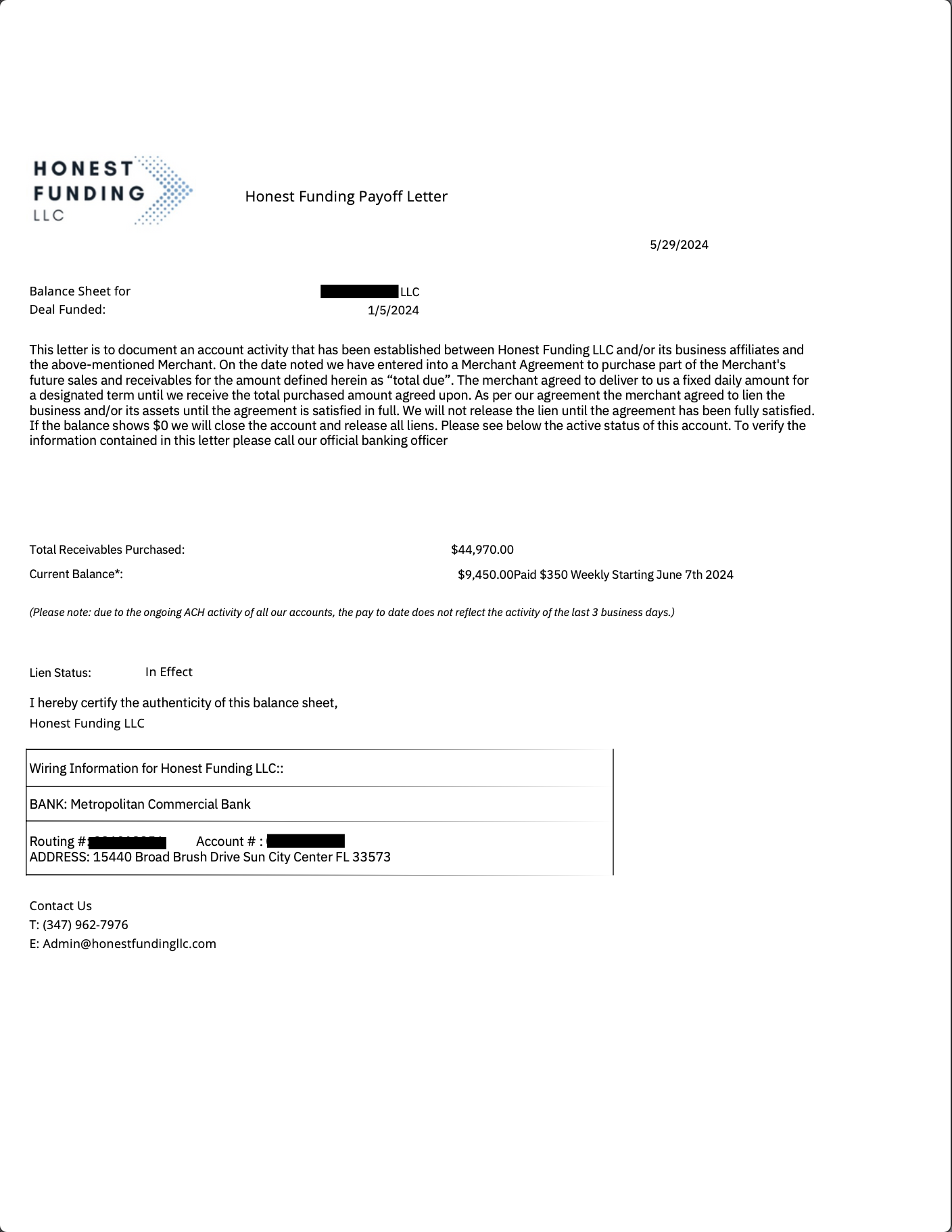

Our Recent Results

Client Results

We Serve

What Makes us Your Perfect Partner ?

Specializing in MCA debts, we convert multiple high daily payments into 1 low weekly payment for business owners of construction, trucking, restaurants, healthcare, auto repair and many more industries to get you debt free within 6-8 months

- Protect Assets

- Manage MCA Debt

- Financial Stability

Blog & Insights

The Impact of Business Debt on Personal Credit Score

Many small business owners rely on personal credit to fund their businesses, especially in the early stages. While this can be helpful, it also carries risks. If business debt is not managed properly, it can affect personal credit scores and financial stability.

Why Quick-Fix Debt Solutions Can Lead to Bigger Problems

Debt can feel overwhelming, and when people are desperate for relief, they often look for quick solutions. Short-term fixes like payday loans, high-interest consolidation loans, and rushed settlements may seem like an easy way out. While it’s natural to want immediate relief from debt, it’s important to consider the long-term effects of any financial decision.

How to Avoid Debt While Expanding Your Business

Expanding a business is exciting, but it often comes with financial risks. Many business owners take on debt to fund their growth, only to find themselves struggling with repayments later. While borrowing money can sometimes be necessary, it is possible to expand without relying too much on debt.